With declining interest rates and new lending rules, demand for housing in markets across Canada picks up in Q4

Activity gained momentum in the final quarter of 2024, resulting in moderate price gains and setting the stage for a brisk spring market

Despite economic and political uncertainty – both in Canada and south of the border – a revival of our national real estate market is underway thanks to lower interest rates, changes to mortgage lending rules, and renewed buyer demand. Strong activity through the final months of 2024 in most major regions from coast to coast resulted in moderate price gains, nationally.

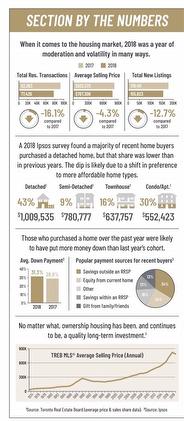

According to the Royal LePage® House Price Survey released today, the aggregate1 price of a home in Canada increased 3.8% year over year to $819,600 in the fourth quarter of 2024. On a quarter-over-quarter basis, the national aggregate home price remained essentially flat, rising a modest 0.5%. While activity began to flourish again in the final months of 2024, following sluggish demand in most major markets over the summer, home price appreciation remained in check last quarter.

“There are several converging factors revitalizing Canada’s real estate market and making home ownership more attainable,” said Phil Soper, president and CEO, Royal LePage. “Interest rates have fallen sharply in recent months, with further reductions expected in 2025. We believe the Bank of Canada could lower rates by another 100 basis points by year end, steadily improving affordability. At the same time, new mortgage rules are already helping younger Canadians by increasing borrowing power and reducing monthly carrying costs.

“While geopolitical uncertainty and concerns over the Trump administration’s proposed trade policies may weigh on consumer confidence, residential real estate remains largely insulated from such external pressures in the short term. Canada’s housing market is fundamentally driven by domestic factors. With strong full-time job growth, improving housing supply in key markets, and more accessible financing, we expect healthy activity levels to persist, even as broader economic challenges unfold,” said Soper.

When broken out by housing type, the national median price of a single-family detached home increased 4.9% year over year to $855,900, while the median price of a condominium increased 1.5% year over year to $592,700. On a quarter-over-quarter basis, home prices remained virtually flat, with the median price of a single-family detached home increasing a modest 0.6%, and the median price of a condominium rising just 0.4%. Price data, which includes both resale and new build, is provided by RPS Real Property Solutions, a leading Canadian real estate valuation company.

What impact will a federal election have on the housing market?

An early federal election has become all but certain following the resignation of Prime Minister Justin Trudeau and the prorogation of government on January 6th. When the House of Commons resumes in late March, an immediate confidence vote is not expected to pass, triggering an election by mid-spring. The Liberal party is expected to select a new leader by March 9th.

“With a federal election campaign at home and an aggressive stance on trade expected from the new U.S. administration, Canadians will be understandably nervous. That said, the critical need for housing in Canada transcends political cycles. The next government must prioritize addressing the supply crisis, which affects millions of Canadians seeking affordable shelter and stability for their families,” Soper commented.

“For more than three decades, we’ve been underbuilding in Canada, a challenge worsened by the pandemic and our rapidly growing population. As we approach the federal election, housing access and affordability will undoubtedly be among the most pressing issues voters will demand candidates address.”

Revised mortgage policies and lower lending rates

New lending regulations came into effect at the end of 2024, aimed at improving accessibility for both first-time buyers and existing homeowners. Changes include the expansion of eligibility for 30-year amortizations on insured mortgages to all first-time homebuyers and all buyers of newly constructed homes, an increase from the previous 25-year maximum. Additionally, the mortgage insurance cap rose from $1 million to $1.5 million, enabling buyers who put less than 20 per cent down to consider higher-priced properties. This change is particularly significant in Canada’s most expensive real estate markets, where average home prices exceed $1 million. And, for those with mortgages renewing, the removal of the stress test requirement for uninsured borrowers switching lenders will allow Canadians greater choice and likely better rates, as banks will offer more competitive options in order to retain and attract clients.

“These regulatory changes mark a significant shift in improving access to home ownership for Canadians,” said Soper. “By expanding amortizations and raising the mortgage insurance cap, first-time buyers and those in high-priced markets will find it easier to purchase a home. Additionally, the removal of the stress test requirement for existing homeowners switching lenders will give Canadians greater choice and likely better rates, as financial institutions compete more aggressively to retain and attract clients.

“While extending the life of a mortgage may result in higher overall interest paid, the reduction in monthly carrying costs will help address one of the most immediate barriers to affordability. These new policies will make the dream of home ownership attainable for more Canadians,” he concluded.

Read Royal LePage’s fourth quarter release for national and regional insights.

Fourth quarter press release highlights:

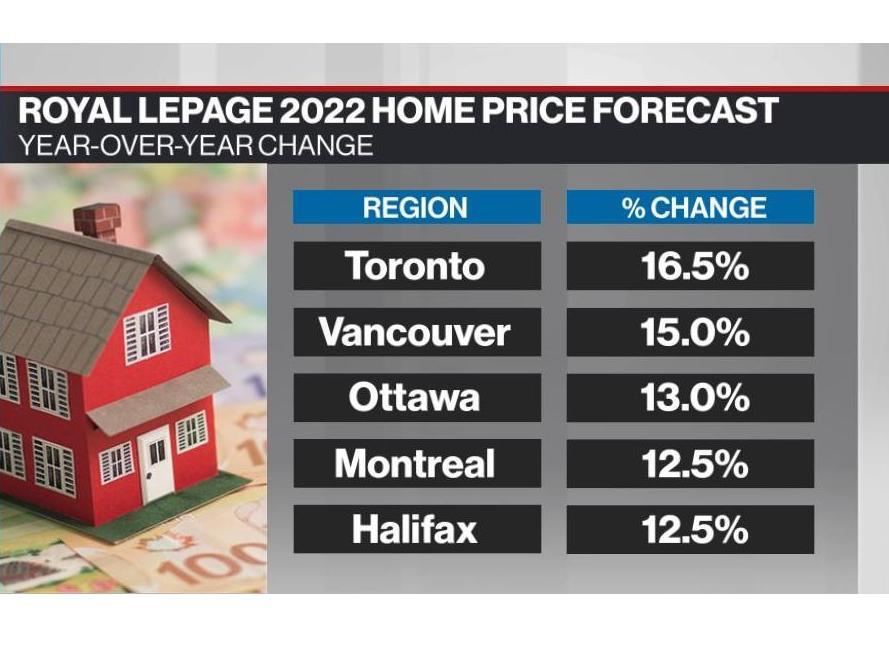

Greater Montreal Area’s aggregate home price increased 8.2% year over year, while the greater Toronto and Vancouver markets recorded more modest gains of 2.3% and 0.7%, respectively.

For the third consecutive quarter, Quebec City recorded the highest year-over-year aggregate price increase (11.3%) in Q4 among the report’s major regions.

Housing policy and affordability expected to be key ballot box issues shaping voters’ decisions in this year’s federal election.

Royal LePage is forecasting that the aggregate price of a home in Canada will increase 6.0 per cent in the fourth quarter of 2025, compared to the same quarter in 2024.

NEW! Royal LePage 2024 Most Affordable Canadian Cities Report

NEW! Royal LePage 2024 Most Affordable Canadian Cities Report

Friday, June 21st, 2024

Friday, June 21st, 2024

_crop_image_2019308007555.jpg)